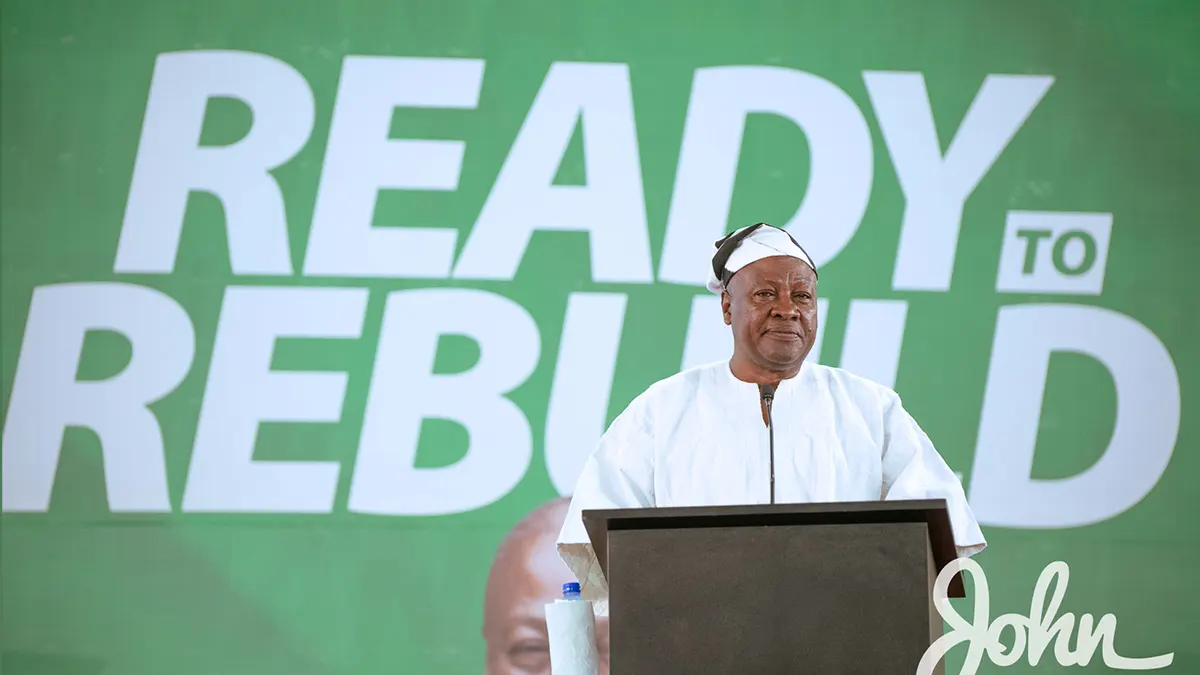

Former President John Dramani Mahama and the flagbearer of the National Democratic Congress for the 2024 elections, has promised to restore collapsed banks. The president made the promise during his formal acceptance speech at the University for Development Studies following his landslide victory at the NDC polls on Saturday.

According to the former president, some of the banks had their licenses unjustly revoked and he will work to solve that if he is elected in 2024. He said the efforts will secure the careers of those who lost their jobs as a result.

“Let me restate what I said in Ho during the launch of my campaign for Flagbearer— we shall promote robust local participation in our banking, financial, telecommunications, tourism, mining, agriculture, agribusiness, and manufacturing sectors to grow the economy and create sustainable employment for the youth.

“We will restore indigenous Ghanaian investment in the finance and banking sector and create a tiered banking system that will serve various segments of the market. We will give the opportunity for experienced banking hands who were laid off, to secure their careers once more and move from the menial jobs they were forced into.

“As far as practicable, banking licenses that were unjustly cancelled by this Government would be restored,” he promised.

Several Ghanaian indigenous banks collapsed while others were taken over by the government-owned GCB Bank Limited. Others were merged to form the Consolidated Bank of Ghana (CBG). Banks such as GN Bank owned by Dr Papa Kwesi Nduom and Heritage Bank owned by Seidu Agongo ceased to operate after their licenses were revoked. Others such as Beige Bank, The Royal Bank, Sovereign Bank, Construction Bank and Kwabena Duffour’s Unibank were consolidated to form CBG.

Some of the collapsed banks have taken the BoG to the courts battling their license revocation. In what has been described as the biggest financial sector cleanup in the country’s history, 23 savings and loans companies were closed. Over 340 microcredit companies, 39 finance houses and 53 fund management companies went down as a result.

Discover more from afkmediaonline

Subscribe to get the latest posts sent to your email.

+ There are no comments

Add yours