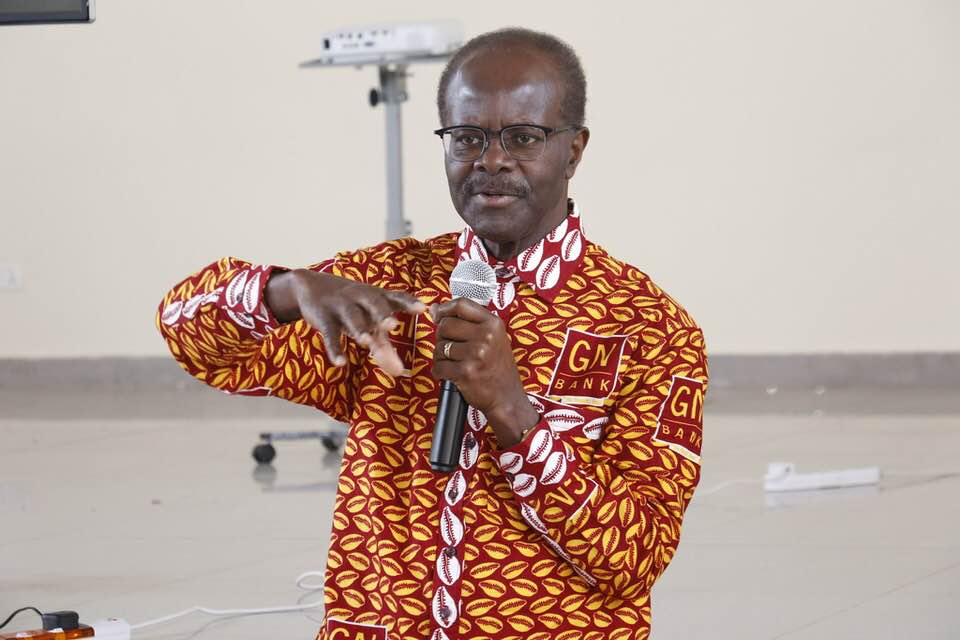

Papa Kwesi Nduom, the founder of GN Bank has made a case for the banking licence of the indigenous bank to be reinstated. The veteran businessman who has been silent albeit with occasional appearances on social media has been battling the decision of the government to revoke his GN Bank’s banking license.

Dr Nduom on Friday, August 11, 2023, made a post on social media giving reasons why the bank’s license needs to be reinstated. He revealed that GN Industrial Site, one company that also had its accounts frozen as a result of the revocation of the bank’s license has just resumed operation. Nduom said the company that produces kitchen utensils could not operate for about three years after its main production machine broke down and it could not access its locked-up funds to repair.

However, the company has been able to fix the issue and “five people and the manager” of the factory have resumed work. He made the statement to emphasise the harm the closure of the bank has done to the population.

What did Nduom say?

“These spoons were produced today at the GN Industrial Site at Elmina. When GN Bank’s license was revoked, the deposits of the company that produces them were frozen. So the main production machine couldn’t be fixed and hadn’t worked in more than three years. It has been fixed today and working. As a result, five people and the Manager are working.”

Meanwhile, the Supreme Court has recently cleared Dr Nduom to challenge the revocation of GN Bank’s license at the High Court. Nduom challenged the revocation of the bank’s license at the High Court but the Bank of Ghana and other respondents to the case file an appeal at the Court of Appeal. The respondents said the appropriate place to challenge the revocation under the specialized deposit-taking institutions ACT was through arbitration. The Court granted the application of the respondents and stayed execution at the High Court.

However, Nduom headed to the Supreme Court to challenge the decision of the Court of Appeal. The Supreme Court after considering the case has given the former presidential candidate the go-ahead to challenge the revocation at the High Court.

Following the Supreme Court’s ruling, Nduom said, “Nobody won here today. Shareholders, employees, government, and customers all have suffered for more than six years – from the uncertainties to the indignities of losing a license; losing scarce jobs, poor health and for some, unfortunately, death.

“We sent petition after petition to the highest levels in the current Administration and Regulators for a win-win settlement but were not successful. So the courts were and remain our last resort.

“The battle has not ended. We want our license back and our task is clear. To rebuild “the People’s Bank” and take formal and safe banking to the doorstep of every person living anywhere in Ghana.

“It took us nearly 20 years to build our bank only for it to be pulled down in one day. We have a national duty to build it back step by step. The end result will be an even better bank than what was pulled down.

“We don’t have time to hate or be against anyone. We want to get back to work. We are looking forward to working diligently with the regulator, the Bank of Ghana, to press the start button to bring back GN Bank,” he said as reported by Joy news.

What happened?

GN Bank, a subsidiary of Groupe Nduom was one of several banks, saving and loans and microfinance institutions that shut down during the finance sector cleanup in 2018.

Paa Kwesi Nduom has since 2018 been chasing the regulators to restore the license of the bank. GN Bank was the fastest-growing bank in the country and was by far the bank with the most coverage in the country alongside GCB Bank with 260 operational branches in all the regions of Ghana.

However, the financial sector cleanup hit it hard and it was downgraded to a Savings and Loans company in January 2019. It was because the bank reportedly could not meet the new minimum capital requirement of GHS400 million to operate as a bank at the expiration of the December 31, 2018, deadline expiration.

A statement by BoG on August 19, 2019, revoked the license of GN Savings and Loans Ltd along with others. The statement said BoG “revoked the licences of twenty-three (23) insolvent savings and loans companies and finance house companies (see Annex 1)”. According to BoG, “These actions were taken pursuant to Section 123 (1) of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930), which requires the Bank of Ghana to revoke the licence of a Bank or Specialised Deposit-Taking Institution (SDI) where the Bank of Ghana determines that the institution is insolvent.”

Discover more from afkmediaonline

Subscribe to get the latest posts sent to your email.

+ There are no comments

Add yours